OUR BLOGS

Articles Written by Tyler Hastings

in-depth guide to safes (“Cracking the Safe” 😎)

Part I (Introduction)

After working in large law firms for years as a startup attorney, I spun off earlier this year to provide an alternative model for early stage companies, who (as I am hearing more and more) often get hit with massive and unexpected bills from large law firms. 🧾🤯

I hope to use my experience in large firms to help founders navigate their vc financing journey. 🧭

So why start with safes? 🤔

Well, while VCs are reviewing term sheets and deal docs on a daily basis, founders may be seeing these same documents for the first time – an imbalance which can lead to lopsided deal terms.

This is especially true in pre-seed safe rounds, where the combination of (i) safes being seen as “standard” and thus not in need of detailed review and (ii) the fact that pre-seed companies using safes often lack the resources for sophisticated legal counsel, can result in very one-sided negotiations.

Safes are not bad per se; they can be a great way to raise capital, for many of the same reasons that investors like them (relatively low-cost, low-friction and high-speed fundraising tool). It is just important to understand what you are getting yourself (and your company) into.

In a small effort towards leveling the playing field, I am releasing Cracking the Safe, which will be published in installments on LinkedIn. If you find any sections of this guide useful, feel free to share with or tag your friends, and if you have general questions about safes or topic suggestions, please send me an email. 🤝

Part II (Exploring the pre- vs. post-money distinction)

The pre- vs. post-money distinction💥💰

➡️ In 2013, YC published the pre-money safe, and then went on to replace this with a post-money version in 2018.

➡️ Post-money safes have now become “standard” in the sense that they are commonly used, but they can still be revised and negotiated. And everything else being equal, post-money safes can leave founders in a worse spot than a pre-money safe.

Here’s why:

With a pre-money safe, the company’s valuation is set prior to the fundraise, and increases dollar-for-dollar with each safe investment: the more money raised, the higher the valuation. ✅

With a post-money safe, this calculation is flipped. The company’s valuation after the fundraise is set at a fixed amount, thereby decreasing the implied valuation prior to the fundraise dollar-for-dollar with each additional safe investment. 📉

Either safe can be used to arrive at the same cap table, the numbers just need to be adjusted. ⚖️

VCs are well aware of these mechanics and are modeling out their safes to understand what their ownership will look like post-conversion. You may want to do the same. 💻

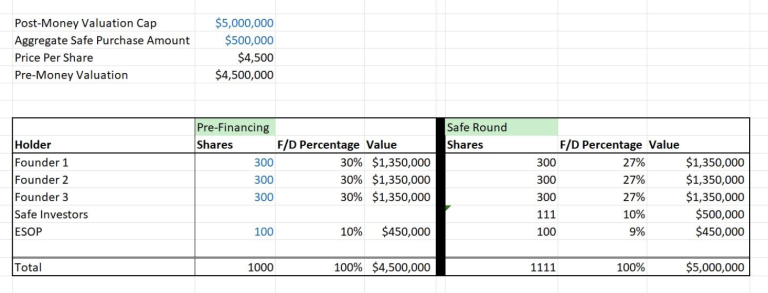

Comment “safe model” and I will send you an excel model that allows you to calculate the potential impact of post-money safes on your cap table by providing just a few inputs, giving you another tool in your toolbox 🧰. (You can see a quick screen grab below).

** There are a bunch of assumptions included above, and this is a partial analysis for illustrative purposes. For example, other convertible securities, increases to the option pool, and the preferred stock financing itself will all impact the cap table. This post is for general informational purposes and does not constitute legal advice.

Cracking the Safe – Part III 🚀🚀🚀

Cracking the Safe - Part IV 🚀🌋

Side letters (often requested by safe investors) can contain a wide variety of terms that impact a company’s trajectory well beyond its pre-seed round.🔮

Therefore, savvy founders will consider both the direct and indirect effects of side letters. 🤔

A side letter may grant a single investor undue leverage. 🔧

While preferred stock financing documents can often be amended with the consent of an investor majority and the company, a side letter (which is usually a two-party agreement directly between the company and an investor) requires a single investor’s express approval to amend or terminate.📍

A side letter may delay, prevent and/or increase the cost of future financings.

Professional investors (or their counsel) will ask to see all active side letters as part of the due diligence process before investing in a company. 🔬📨

A new investor may ask (a) for the same terms or (b) that the side letter be terminated, both of which can be problematic depending on the situation.

As one example, a side letter could grant a safe investor Major Investor status in the next round financing, regardless of the size of its preferred stock holding – a right that a new series seed investor could take issue with.

What rights have you seen requested in side letters?

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Hello world!

Hello world!

Have any questions or need more info?

Don’t Hesitate To Contact Us ANy Time.

Dilution from esop expansion can be shared by investors or borne by founders alone.

ESOP is a group of shares that a company has set aside to issue to future service providers, and is often increased in connection with fundraising events. 📈💰

Because these shares are already reserved for issuance, they are often included in the denominator of ownership calculations.

ESOP can be a complex topic with many nuances that are beyond the scope of this post, but it is an important piece of high-growth startups and building a cap table. 🔨

The default language in the YC post-money safe has the founders and the safe investors sharing the dilution from increases to the option pool made in connection with a preferred stock financing (with a caveat for certain options that were promised but not granted). 🤝

Understanding esop when speaking with investors can help you negotiate effectively on behalf of your company, and also signal that you are a serious entrepreneur who has done your homework on various facets of venture-backed companies. 📚